EU Scrambles for Unity on Greenland as Trump Links Territory Dispute to Trade Tariffs

Brussels is moving quickly to contain a new wave of transatlantic tension after U.S. President Donald Trump explicitly linked the Greenland dispute to the threat of additional trade tariffs against several European countries. EU leaders are now preparing an extraordinary summit aimed at forging a common position, as political pressure increasingly intersects with economic leverage. NATO has also been pulled into the spotlight, while EU institutions and member states weigh potential countermeasures—raising the stakes for European unity, market stability, and the rules-based order Europe says it wants to defend.

An extraordinary EU summit: Brussels tries to lock in a common line

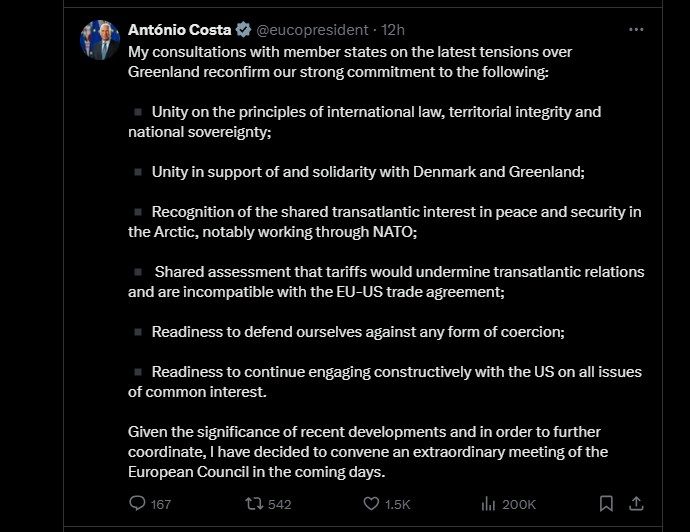

The decision to convene an extraordinary summit signals that EU leaders see the situation as more than a rhetorical flare-up. At its core is a sensitive reality: Denmark is an EU member state, and Greenland is an autonomous territory within the Kingdom of Denmark. That structure makes the dispute both a matter of European solidarity and a test of the EU’s ability to defend principles it routinely invokes—territorial integrity, political self-determination, and the inadmissibility of coercion.

European Council President Antonio Costa has indicated that EU leaders will meet “in the coming days” in Brussels. At the working level, consultations among ambassadors from the 27 member states have already intensified, with officials seeking to calibrate both messaging and policy options. The objective is clear: avoid a fragmented reaction that would invite further pressure, while keeping space open for de-escalation.

The Arctic dimension adds weight to the summit’s urgency. Greenland sits in a region of rising strategic competition—where security posture, critical infrastructure, and access to future economic routes have become increasingly central to great-power calculations. Any hint that sovereignty questions might be negotiated under tariff pressure is therefore treated in Brussels as an issue with ramifications far beyond the immediate headlines.

Trump’s tariff leverage: turning a geopolitical dispute into a trade weapon

The immediate trigger for the EU’s response is Trump’s pressure tactic: tying the Greenland question to the threat of escalating tariffs. In public reporting, the demand has been framed as an expectation of a far-reaching arrangement over Greenland—described in blunt terms as a “full and complete sale”—backed by a tariff timeline designed to force rapid concessions.

According to accounts referenced in international coverage, the tariff path discussed would begin with a 10% rate from 1 February, with the possibility of increasing to 25% from 1 June if no agreement is reached. Importantly, the list of potential tariff targets extends beyond Denmark. Several allied European states—Germany, France, the United Kingdom, the Netherlands, Norway, Finland, and Sweden—have been cited as possible targets, signaling a strategy that could spread economic pain across multiple capitals and complicate EU coordination.

Greenland has repeatedly indicated it does not want to become part of the United States. That position is not a footnote: it places local self-determination at the heart of a dispute framed by Washington in strategic terms. With a small population and strong sensitivity to external decision-making, Greenland’s stance raises the political and reputational costs of any outcome perceived as imposed, transactional, or coerced.

EU countermeasures take shape: tariffs, market access, and anti-coercion tools

The EU’s internal debate has quickly moved into deterrence logic. If pressure comes via trade instruments, Brussels and member states are considering a response in kind. Two broad options have been circulating in consultations.

The first is a tariff response targeting U.S. imports—figures mentioned in reporting include an estimated package worth €93 billion. The second option, viewed as more severe, would involve restricting access for U.S. companies to parts of the EU single market. While tariffs strike at goods and supply chains, market-access restrictions could affect the ability of American firms to sell services, compete in regulated sectors, or operate under the privileges that come with Europe’s integrated market. In strategic terms, this is the difference between a punitive signal and a structural escalation.

Also in the background is the EU’s Anti-Coercion Instrument, a framework designed for scenarios where a third country tries to force political decisions through economic pressure. The instrument provides a pathway toward targeted countermeasures after assessment and attempts at de-escalation. Its relevance in this case lies in the EU’s desire to frame the dispute not merely as a trade argument, but as coercion aimed at altering political outcomes.

For European businesses, the implications are immediate: even the threat of tariffs can reshape planning assumptions, disrupt pricing, and raise uncertainty in integrated supply chains. For consumers, escalation can filter through into higher prices and additional volatility—particularly in sectors where cross-Atlantic trade is tightly interwoven.

But for the EU politically, the largest challenge may be internal cohesion. Any strong response requires agreement across member states that do not share the same exposure to U.S. trade or the same appetite for confrontation. Building a unified stance fast—before tariff deadlines become real—is one reason the extraordinary summit has taken on urgency.

NATO drawn in: Arctic security becomes part of the conversation

While the EU focuses on the political and economic dimensions, NATO is being pulled into the equation through the security framing often attached to Greenland and the Arctic. NATO Secretary General Mark Rutte is expected to meet in Brussels with ministers from Denmark and Greenland amid the rising tensions.

Reports have indicated that Greenland’s foreign minister Vivian Motzfeldt and Denmark’s defense minister Troels Lund Poulsen are expected at NATO headquarters, without a press conference announced in advance. The meeting carries a dual purpose: managing alliance optics and ensuring that a dispute between allies does not harden into a strategic fracture.

European officials have emphasized a core counter-argument: Arctic security can be strengthened through allied cooperation and established commitments, without revisiting sovereignty arrangements. In other words, if Washington frames its position as driven by “strategic necessity,” Brussels is seeking to demonstrate that the same objectives can be met through coordination—without turning territorial status into a bargaining chip.

What happens next: summit decisions, Davos diplomacy, and the risk of retaliation spirals

The next days will be defined by two parallel tracks. First, the extraordinary EU summit is meant to lock in a common posture and agree the bloc’s negotiating boundaries—before national politics and economic interests fragment the message. Second, informal diplomacy—particularly around global gatherings such as the World Economic Forum in Davos—could offer channels for de-escalation, where leaders can test compromises without immediately converting them into policy.

A controlled de-escalation scenario would likely involve a retreat from explicit tariff timelines, a shift back to cautious language, and an attempt to separate the Greenland dispute from trade measures. An escalation scenario would see tariffs implemented, followed by EU countermeasures and possibly wider restrictions, pulling the conflict out of political messaging and into economic reality. Once trade retaliation begins, inertia sets in: affected sectors lobby harder, timelines become embedded, and compromise becomes costlier.

Internally, the EU also faces a credibility test. If a territory linked to a member state can be treated as leverage in trade negotiations, Europe risks undercutting its own narrative about sovereignty norms and rules-based governance. That reputational cost is part of what is driving Brussels to frame the crisis as a matter of principle as well as policy.

Longer-term stakes: Europe’s strategic autonomy and a tougher EU–U.S. baseline

Even if the immediate confrontation cools, the episode could mark a shift in the EU–U.S. relationship—one where economic tools are used more openly to pursue geopolitical aims. The Arctic context reinforces that concern: Greenland sits in a region where strategic competition is intensifying, and where questions of security posture, infrastructure, and influence are becoming sharper.

For the EU, the crisis may accelerate debates on strategic autonomy and on whether the bloc has the political and institutional capacity to respond quickly and collectively under pressure. For NATO, it raises a difficult question about alliance management: how to contain major disagreements among allies without creating fractures that competitors can exploit.

Ultimately, the Greenland dispute forces Europe to answer a direct question: where does it draw the line when political outcomes are pursued through economic coercion? The extraordinary summit is expected to be an attempt to turn that question into a clear, credible stance—one that can deter escalation while keeping the door open for negotiation.